Śnieżka publishes results for three quarters of 2025

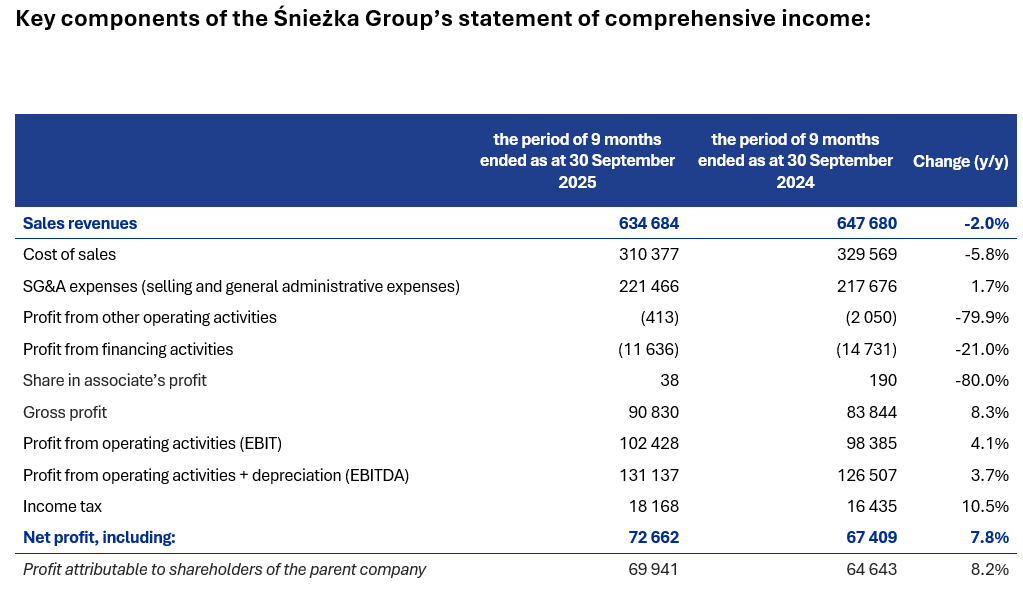

Following the first three quarters of 2025, the Śnieżka Group generated PLN 634.7 million in sales revenues, representing a 2.0% year-on-year decline. Despite the weaker revenue performance, profitability improved: EBITDA increased by 3.7% year-on-year to PLN 131.1 million, while net profit rose by 7.8% year-on-year to PLN 72.7 million.

Domestic sales in the first three quarters of 2025 amounted to PLN 466.8 million, representing a 0.5% year-on-year increase and accounting for 73.6% of consolidated revenues. In the Hungarian market, revenues decreased by 3.9% year-on-year, reaching PLN 81.4 million. Sales in the Ukrainian market amounted to PLN 61.6 million, representing a 4.5% year-on-year decline.

In the third quarter alone, the Śnieżka Group generated PLN 254.4 million in revenues (+3.8% y/y), PLN 64.7 million in EBITDA (+9.3% y/y), and PLN 41.4 million in net profit (+16.0% y/y). Revenues in Poland during this period totalled PLN 187.6 million (+5.0% y/y), in Hungary PLN 33.9 million (+7.5% y/y), and in Ukraine PLN 22.2 million (+2.7% y/y).

We build our competitive advantage on strong brands, a carefully selected product portfolio, and modern production and logistics processes, all of which translate positively into our business performance. Despite lower-than-expected consumer activity in the sector, we improved our profits both cumulatively and in Q3 itself. The economic environment in Poland is improving, given the on-going cycle of interest rate cuts; however, the data available to us indicate that a significant share of consumer spending is directed toward areas other than home renovation. Aware of the current market conditions, we remain focused on executing the “Focus and Grow 2028” strategy as well as maintaining cost discipline: the net debt to EBITDA ratio amounted to 1.14 at the end of September.

In the first three quarters of the year, the decorative paints market in Poland recorded a single-digit y/y decline in both value and volume terms, which means that the Company outperformed the market — sales increased by 0.5%, reaching PLN 466.8 million. In Hungary, the market grew at a single-digit rate y/y in both value and volume terms, while the Company’s performance was weaker than the market — revenues declined by 3.9%, to PLN 81.4 million. In Ukraine, the market grew y/y in value terms while recording a single-digit decline in volumes, resulting in performance broadly in line with the market — the Company’s sales decreased by 4.5%, to PLN 61.6 million.

Profitability after the first three quarters of the year was positively affected, among other factors, by a PLN 19.2 million y/y reduction in cost of goods sold and a PLN 3.1 million y/y improvement in the financial result, driven by lower debt servicing costs. EBITDA margin in this period reached 20.7% (+1.2 p.p. y/y), and in Q3 alone stood at 25.4% (+1.3 p.p. y/y). Gross profit margin after the first three quarters amounted to 51.1% (+2.0 p.p. y/y) and reached 52.9% in Q3 (+2.5 p.p. y/y), driven by a favourable relationship between production costs and generated sales.

At the end of September 2025, the Group’s net debt / EBITDA ratio stood at 1.14, compared with 1.6 a year earlier.