Śnieżka reports financial results for H1 2025

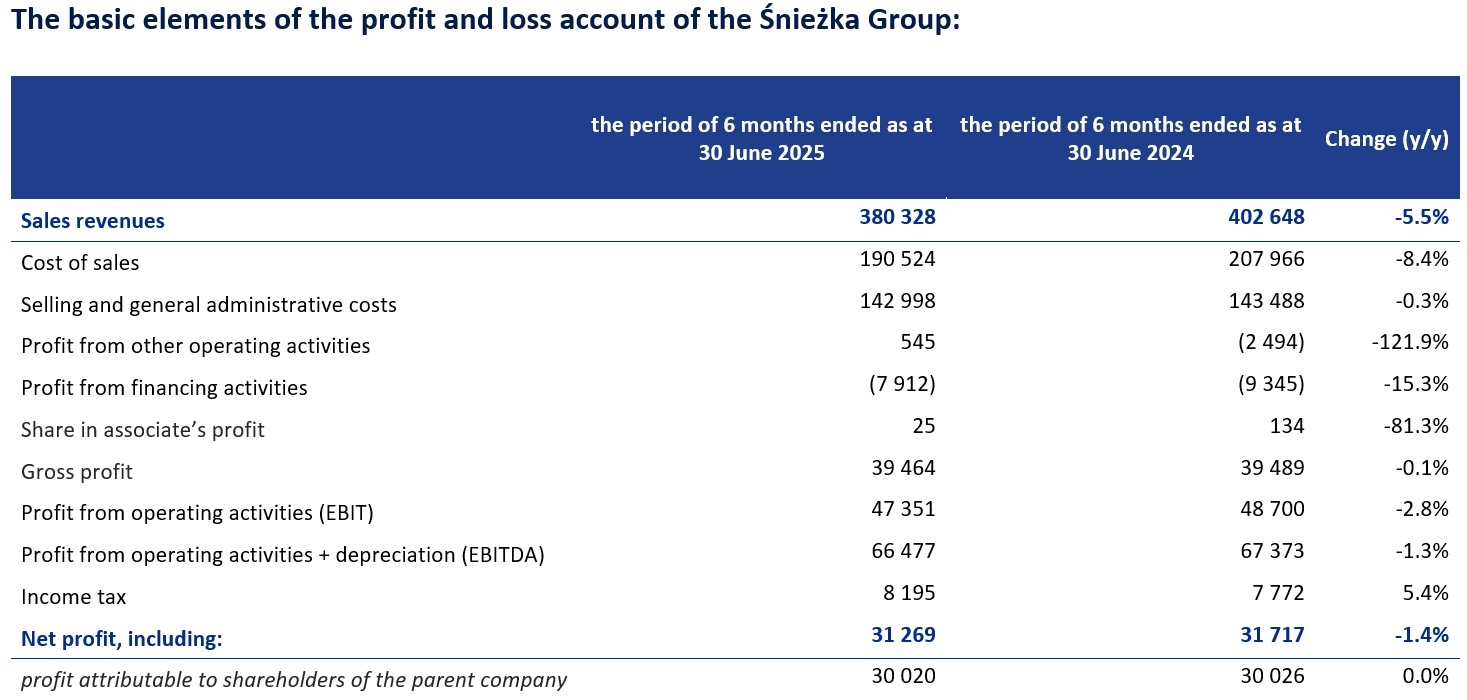

In H1 2025, the Śnieżka Group reported sales revenues of PLN 380.3 million, versus PLN 402.6 million in H1 2024. EBITDA in H1 2025 stood at PLN 66.5 million, slightly down from PLN 67.4 million in the prior-year period, while net profit amounted to PLN 31.3 million compared to PLN 31.7 million in H1 2024.

The Group’s performance in the first half of 2025 was impacted by adverse macroeconomic conditions, which translated into consumer behaviour and purchasing patterns. No recovery was observed in the paints market.

Neither the macroeconomic environment nor the conditions in the paints sector showed improvement in Q2 2025, resulting in lower sales across H1 2025. Given these circumstances, the Group concentrates on enhancing resilience, in particular through strict cost discipline and gradual deleveraging – with the net debt to EBITDA ratio at 1.69 as of the end of June 2025. These results demonstrate the Group’s capacity to operate effectively and sustain its market position, notwithstanding continued demand challenges across key markets.

The decrease in sales was the main factor weighing on the Group’s profitability in H1 2025. As a result of strict cost discipline, selling and general administrative expenses declined by almost PLN 0.5 million compared to the previous year. In H1 2025, EBITDA margin reached 17.5%, up 0.8 % year-on-year; in Q2 alone, it was 19.1%, an increase of 1.3 % versus Q2 2024. In H1 2025, the Group recorded a gross profit margin of 49.9%, versus 48.4% in the prior-year period, attributable to a favourable cost-to-sales ratio.

The value of domestic sales totalled PLN 279.2 million in the first half of 2025, a decline of 2.3% year-on-year, and represented 73.4% of the Group’s consolidated revenues. On the Hungarian market, sales revenues fell 10.7% compared to the previous year and totalled PLN 47.5 million. Revenues from the Ukrainian market reached PLN 39.4 million, an 8.2% decrease year-on-year. Additionally, the results were adversely affected by the appreciation of the Polish zloty against the HUF and the UAH.

As at 30 June 2025, the Group’s net debt/EBITDA ratio was 1.69 versus 2.08 in the prior-year period.