The Śnieżka Group published the results for 2024

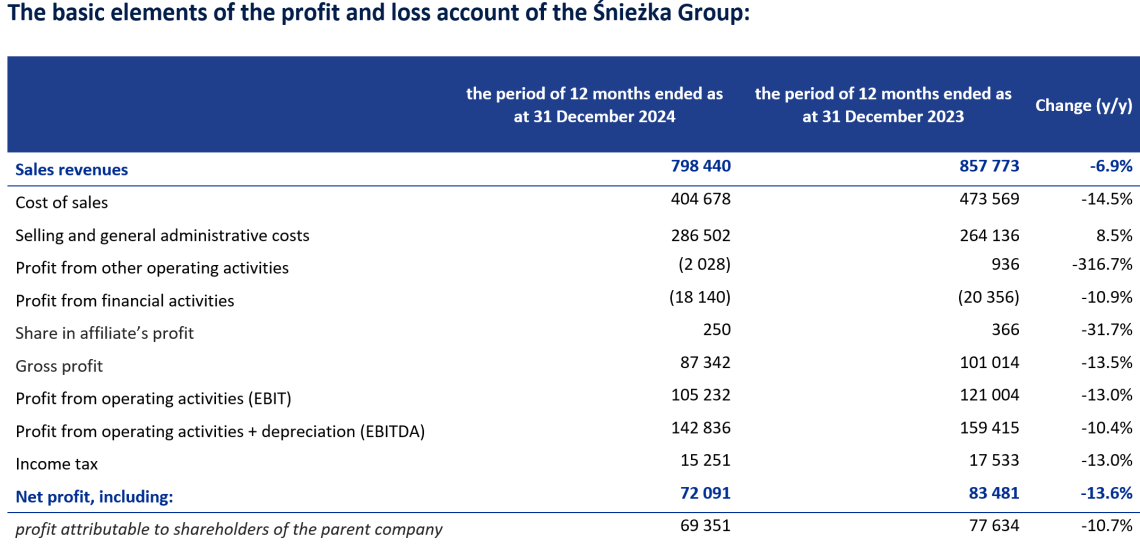

In 2024, the Śnieżka Group generated sales revenues of PLN 798.4 million compared to PLN 857.8 million a year earlier. In the period subject to review, EBITDA amounted to PLN 142.8 million compared to PLN 159.4 million in the previous year, and net profit reached PLN 72.1 million versus PLN 83.5 million a year earlier.

The decline in results is primarily the result of lower sales volumes across the market, arising from challenging macroeconomic conditions. Additionally, the level of results was negatively affected by the strengthening of the PLN against the HUF and the UAH. Despite unfavourable external conditions, the Śnieżka Group increased its market share in Poland and Ukraine.

The year 2024 brought tough market conditions that had a meaningful impact on the entire industry. High interest rates and weak real wage growth weakened consumers' financial situation, forcing them to be more cautious in making purchasing decisions. Consequently, the decline in demand led to a reduction in sales volumes across the market. Despite difficult external conditions, we improved our gross sales profitability. Achieving this result was feasible owing to several essential elements: optimization of production and logistics processes, effective cost management, effective pricing strategy and an increase in the share of premium products in our portfolio. Additional support was provided by the strengthening of the PLN against the EUR.

In 2024, the decline in the Group’s profitability was the aftermath of lower sales levels and an increase in selling and general administrative costs by 8.5% compared to the previous year. EBITDA profitability in the analysed period amounted to 17.9%, which represents a 0.7% decrease compared to the previous year, but it is still a very good result compared to the entire industry.

The value of domestic sales in 2024 reached PLN 576.8 million, which represents a decrease by 2.4% compared to 2023, constituting 72.2% of consolidated revenues. In the Hungarian market, revenues decreased by 19.8%, totalling PLN 102.8 million. Sales on the Ukrainian market amounted to PLN 80.6 million, which represents a fall by 8.9% y/y.

The Group’s capital expenditures (CAPEX) in 2024 amounted to PLN 30.5 million, which is 24.9% lower than anticipated. The company reiterates its previous statement that CAPEX allocation will be equal to depreciation level. Ensuring the stability of on-going operations remains the top priority.

– Following the completion of a major investment cycle that significantly strengthened our production and logistics resources, the current CAPEX is focused on maintaining existing operational capabilities. We assume that average annual CAPEX expenditure will not exceed the depreciation level. Our competitiveness is based on strong brands, a carefully selected product portfolio and modern production and logistics processes that enable us to flexibly respond to market needs. These solid foundations provide a good basis for growing financial results in the coming years, especially when market conditions improve – summarises Piotr Mikrut, CEO of Śnieżka SA.