Śnieżka doubled its net profit in 2023

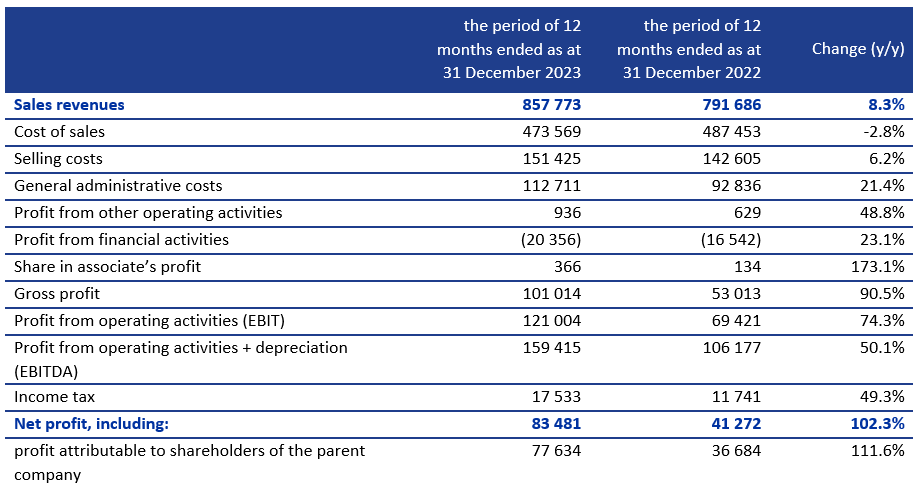

The Śnieżka Group generated PLN 857.8 million in sales revenues in 2023, which means a year-on-year increase of 8.3%. In the analysed period, the EBITDA amounted to PLN 159.4 million and the net profit was PLN 83.5 million, i.e. 50.1% and 102.3% more, respectively, compared to 2022.

With the release of the annual report, the Śnieżka Group presented its strategic objectives for 2028, including:

– achieving consolidated net revenues of PLN 1.1 billion,

– EBITDA margin of 18%,

– increasing market share to over 20% in key countries of operation, i.e. Poland, Hungary and Ukraine.

The Management Board of Śnieżka recommends the payment of a dividend from the profit for 2023 in the amount of almost PLN 40 million, i.e. PLN 3.17 per share. The final decision regarding dividend payment will be made by the company’s shareholders during the OGM.

Solid growth in a challenging environment

In a challenging environment of high inflation and interest rates, which led to weakened consumption, we performed very well in 2023. In particular, we are satisfied with achieving the goal of returning to the pre-pandemic profitability levels. The EBITDA margin in the analysed period accounted for 18.6%, which means a year-on-year increase of 5.2%, and is a record result, above our expectations and the industry average. It was possible to achieve this result owing to the strong foundations built in previous years. These include: strong brands and effective sales and marketing strategies, including pricing. We have consistently adjusted the prices of our products, addressing the growing costs of production, transport and wages.

Advanced automation and digitalization also played a key role, especially in the areas of logistics and production. The premiumization trend, which has been ongoing for several years and observed on our key Polish market, has also proven to be consistently beneficial for our Group. It involves increased consumer interest in higher quality products, which is perfectly in line with the portfolio of our Magnat and Vidaron brands.

The sales growth was largely driven by a 10% year-on-year increase in turnover in the Group’s key Polish market. The value of domestic sales reached PLN 591.1 million, which represented 69% of consolidated revenues. In Ukraine, after a previous period of decline, the Group recorded a significant increase in revenues compared to the previous year. The sales on the market in question amounted to PLN 88.4 million, which denotes an increase of 29.6% compared to 2022. In Hungary in turn high inflation, which reached 17.6% in 2023, negatively affected the purchasing power of consumers. Consequently, the Hungarian market revenues decreased by 6.3% y/y, reaching PLN 128.2 million.

At the end of 2023, the Group’s net debt/EBITDA ratio was 1.38 compared to 2.66 a year earlier.

The basic elements of the profit and loss account of the Śnieżka Group:

2028 strategic objectives

The Śnieżka Group presented its strategic objectives for 2028. It will strive to achieve consolidated net revenues of PLN 1.1 billion, an EBITDA margin of 18%, and an increase in market share to over 20% in key countries of operation, i.e. Poland, Hungary and Ukraine.

The Group also intends to further increase the recognition of its key brands: Śnieżka, Magnat, Poli-Farbe and Vidaron. The Group’s ambition for the above-mentioned brands is to make them one of the three most frequently recognizable brands by consumers in a survey conducted on the Group’s main markets. Additionally, FFiL Śnieżka plans to systematically improve its ESG indicators, which are rated by EcoVadis. Also, the Group is to focus on creating an engaging work environment, measuring results through eNPS employee surveys, with the goal of achieving a positive result reflecting team satisfaction and engagement.

The plans include maintaining the management board’s dividend policy (payment of up to 50% of the Group’s net profit attributable to the shareholders of the parent company, up to reducing the net debt ratio to one-time consolidated EBITDA) and implementing investments in line with previous assumptions.

Since the beginning of 2024, the Group has expanded the distribution model on the independent market in Poland. Selected retail outlets that were previously serviced indirectly by distributors can simultaneously make purchases directly from Śnieżka. The expansion was possible thanks to successfully made investments in the Logistics Centre and IT systems. Extending the distribution model on the independent market may have a negative impact, difficult to estimate, on the Group’s performance in the coming quarters. However, in the long term, it is an important step in the further development of the Group and building its competitive advantages.