Śnieżka reviews the results for Q1 of 2025

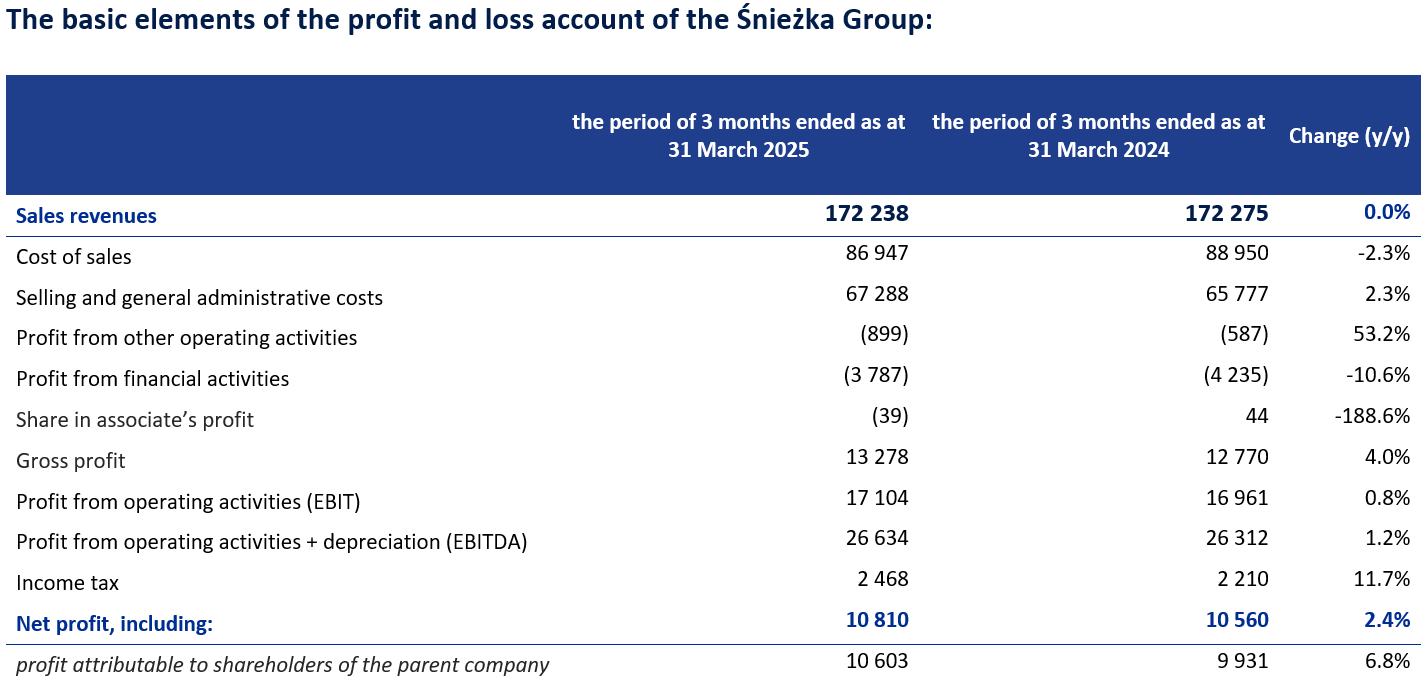

The Śnieżka Group generated in Q1 PLN 172.2 million in sales revenues, nearly as much as in the corresponding period of last year. In the reported quarter, EBITDA amounted to PLN 26.6 million compared to PLN 26.3 million a year earlier, while net profit reached PLN 10.8 million compared to PLN 10.6 million in Q1 of 2024.

In the period subject to review, the Group’s results were affected by the still challenging macroeconomic situation weakening consumer activity and the lack of improvement on the paint market, where year-on-year sales volumes were comparable. The situation is particularly demanding in Hungary, where sales in Q1 of 2025 fell by nearly 18% y/y.

We anticipate that 2025 will bring stabilization of sales volumes on a market scale, with a chance for a slight increase, although it will be rather symbolic. The situation in our industry is largely depended on consumer attitudes and the decisions of central banks, which may impact the level of household spending. Following an intensive period of development investments in recent years, we are now focusing on maintaining operational efficiency, planning net capital expenditures this year at around PLN 41 million. As far as raw materials are concerned, we expect a continuation of the 2024 trend – relative price stability and possible moderate increases in some components.

In Q1 of 2025, the Group’s profitability was negatively affected by a rise in selling and general administrative costs by 2.3% year-on-year, caused by higher expenses on salaries and external services. EBITDA profitability in the analysed period amounted to 15.5%, which represents a 0.2% increase compared to the previous year. In Q1 of this year, the gross sales margin went up to 49.5% compared to 48.4% in the same period of the previous year, which resulted from a favourable relationship between production costs and sales value.

The value of domestic sales in Q1 of 2025 reached PLN 128.5 million, which represents an increase by 3.3% y/y, constituting 74.6% of consolidated revenues. In the Hungarian market, revenues decreased by 17.9% y/y, totalling PLN 18.9 million. Sales on the Ukrainian market amounted to PLN 18.7 million, which represents a fall by 1.3% y/y. Additionally, the level of results was negatively affected by the strengthening of the PLN against the HUF and the UAH.

At the end of March 2025, the Group’s net debt/EBITDA ratio was 1.58 compared to 1.88 a year earlier.

The Management Board of Śnieżka recommended the payment of a dividend from the profit for 2024 in the amount of almost PLN 34,7 million, i.e. PLN 2.75 per share. The final decision on the distribution of last year’s profit is to be made by the company’s shareholders during the general meeting convened for June 3. The Company’s shareholders have received PLN 544.2 million since its debut on the WSE.