Śnieżka publishes results for three quarters of 2024

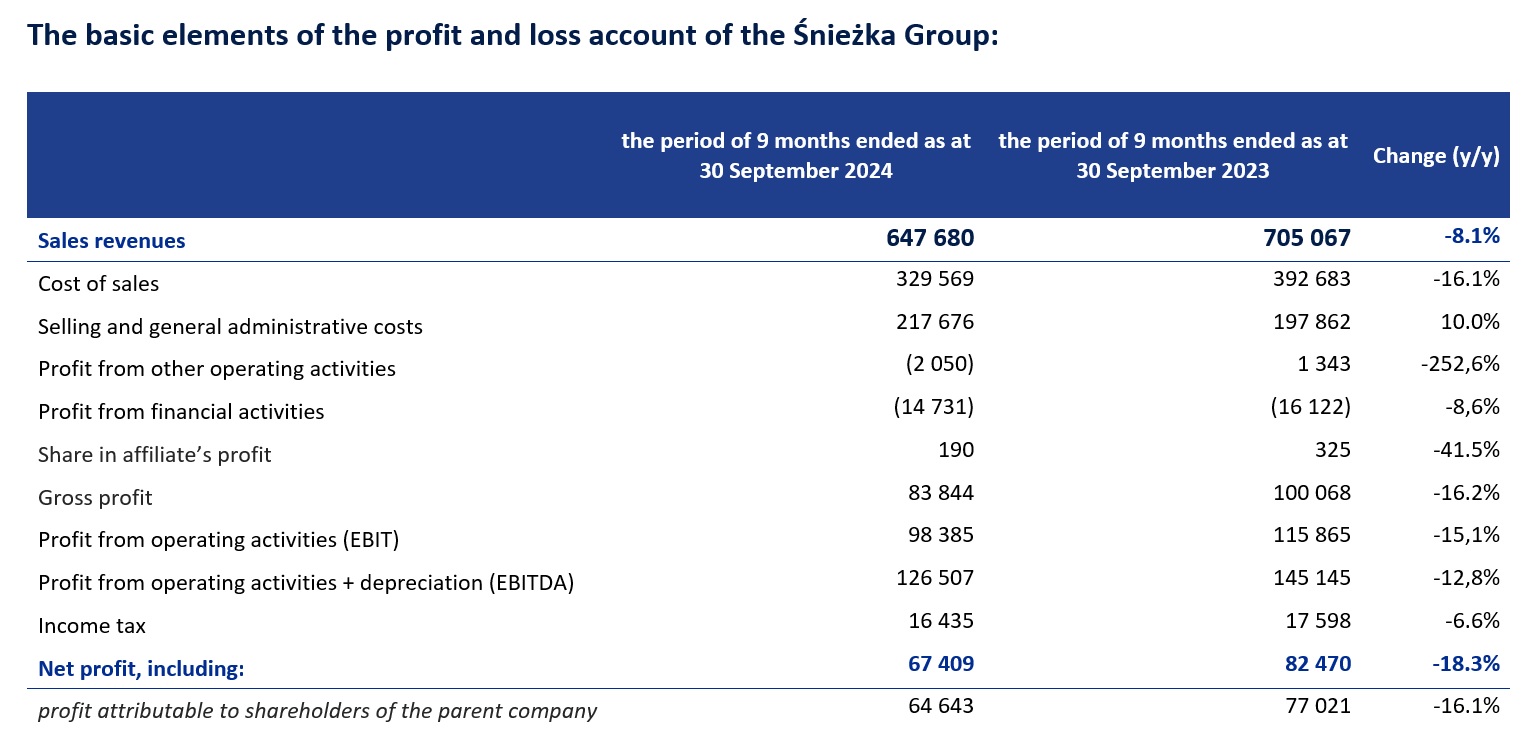

The Śnieżka Group generated in Q1-3 of 2024 PLN 647.7 million in sales revenues, which represents a year-on-year decrease by 8.1%. In the analysed period, the EBITDA amounted to PLN 126.5 million and the net profit was PLN 67.4 million, i.e. 12.8% and 18.3% less, respectively, compared to the same period of the previous year.

The decline in results is mainly the aftermath of lower sales in volume terms on the entire market and the appreciation of PLN against HUF and UAH. Additionally, relatively unfavourable macroeconomic conditions still persist. Despite unfavourable external conditions, the Śnieżka Group maintained market share in Poland.

In the first three quarters of 2024, the Śnieżka Group achieved a gross sales profitability of 49.1%, which represents an increase by 4.8 % compared to the previous year.

The market situation remains difficult, which is reflected in the falling sales volume across the market. The key factors influencing demand for our products are the condition and sentiment of consumers, which are affected by, inter alia, high interest rates and low real wage growth. Although consumer sentiment is slowly improving, this has not yet translated into purchasing decisions in our industry. Currently, we see that it will be impossible to maintain sales volumes at last year's level.

– It is also worth highlighting that the gross sales profitability in the analysed period amounted to 49.1%, i.e. 4.8 % higher compared to the previous year. The main reasons for this growth are the stronger złoty against the euro, improved production and logistics efficiency, optimal pricing policy and effective control of production costs. However, this level of profitability will be difficult to maintain in the coming quarters, adds Wróbel-Lipa.

The fall in the Group’s profitability in the first three quarters of 2024 was caused by lower sales as well as a 10% increase in selling, general and administrative costs compared to the previous year. EBITDA profitability in the analysed period amounted to 19.5%, which represents a decrease by 1.1 % compared to the previous year, but it is still a very good result compared with the entire industry.

In the first three quarters of 2024, the value of domestic sales reached PLN 464.6 million, which accounts for a decrease of 4.3% compared to the previous year and represents 71.7% of consolidated revenues. Sales on the Ukrainian market amounted to PLN 64.5 million and were lower by 8.9% compared to the same period last year. In Hungary, revenues decreased by 19.7%, reaching PLN 84.8 million.

The Group has recorded stabilization in raw material prices, with the exception of occasional, small increases in the prices of pigments, titanium white, dolomite fillers and calcium carbonates. The availability of raw materials and packaging has improved significantly, and incidental difficulties in obtaining certain materials do not affect the continuity of production. In addition, the stronger exchange rate of PLN against EUR than a year ago, which is mainly utilized to settle purchases of raw materials, supports cost stability.

In the first three quarters of 2024, the Group’s capital expenditures (CAPEX) amounted to PLN 23.2 million. Expenditures in 2024 will be lower than the assumed PLN 40 million.

– The key factor influencing the bottom line remains the situation on the decorative paints market. From an operational point of view, the company consistently invests in building competitive advantages, such as strong brands, a tailored product portfolio and modern, digitalised production and logistics processes. Any improvement in the market situation should translate into better performance in the coming year – sums up Wróbel-Lipa.