Śnieżka publishes results for Q1 of 2024

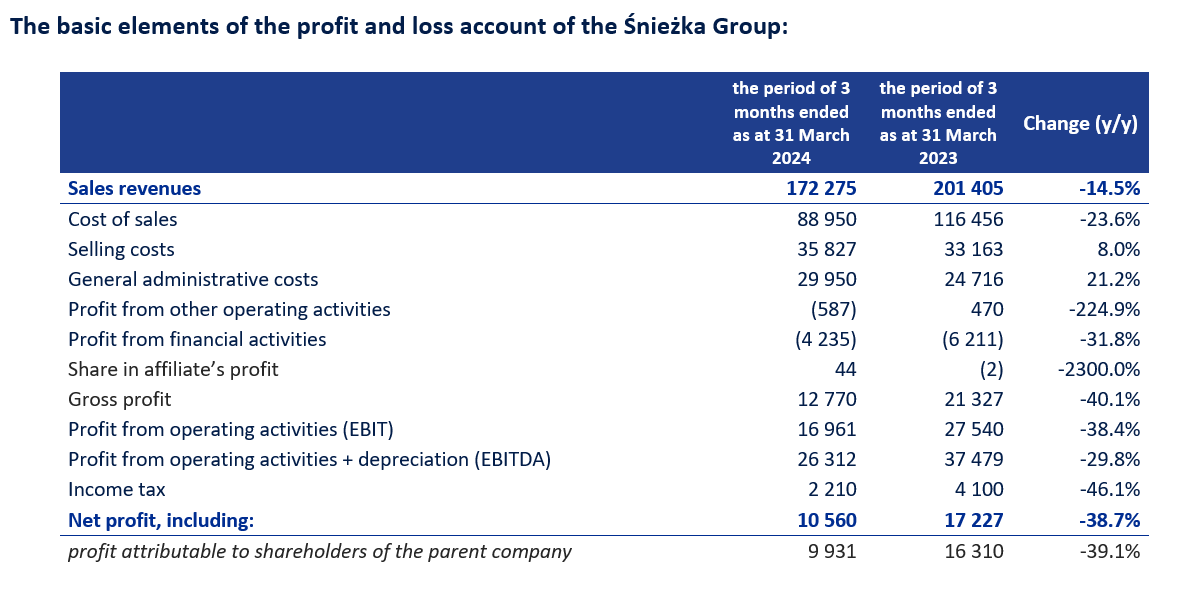

The Śnieżka Group generated in Q1 PLN 172.3 million in sales revenues, which means a year-on-year decrease by 14.5%. In the analysed period, the EBITDA amounted to PLN 26.3 million and the net profit was PLN 10.6 million, i.e. 29.8% and 38.7% less, respectively, compared to the same period of the previous year.

The performance decline is the aftermath of strengthening of PLN against HUF and UAH and the implementation of changes in the distribution model on the independent market in Poland. However, in the long run, expanding the distribution model is a vital step in the further development of the Group and building its competitive advantages. On May 29, the Company is to pay nearly PLN 40 million in dividends, i.e. PLN 3.17 per share. In total, taking into account the nearest payment, In total, the Company’s shareholders received PLN 544.2 million since the debut on the WSE.

Since the beginning of 2024, we have introduced changes in the distribution model on the independent market in Poland.Selected retail outlets that were previously serviced indirectly by distributors can simultaneously make purchases directly from the Śnieżka Group. The expansion of the model was possible thanks to successful investments in the Logistics Centre and IT systems. The change introduced on the independent market had a negative impact on the Group's performance in the first quarter of this year. This trend may also be evident in the subsequent quarters of 2024, yet since the beginning of April, we have not noticed a negative impact of the model expansion on revenues. In the long run, this change is an essential step in the further development of the Group and building its competitive advantages.

In addition to the decline in sales, the Group’s profitability was reduced by an increase in general and administrative expenses by 21.2% year-on-year and sales costs by 8.0% year-on-year.

The EBITDA margin in Q1 of 2024 amounted to 15.3%, which denotes a year-on-year fall by 3.3%. Concurrently, owing to a 23.6% decrease in production costs, the Group generated a 48.4% gross margin on sales, i.e. by 6.2% higher y/y.

The value of domestic sales reached PLN 124.4 million, i.e. by 16.1% less y/y, accounting for 72.2% of consolidated revenues. In Ukraine, the Group recorded an increase in revenues compared to the previous year. The sales on the market in question amounted to PLN 18.9 million, which denotes an increase of 13.8% y/y compared to Q1 of 2023. While, the Hungarian market revenues decreased by 14.8% y/y, reaching PLN 23 million.

At the end of March 2024, the Group’s net debt/EBITDA ratio was 1.88 compared to 2.72 a year earlier.

Over PLN 0.5 billion of dividends paid in the Group’s history

During the OGM of FFiL Śnieżka SA, held on April 26, 2024, the Company’s shareholders adopted a resolution on the payment of dividend from the profit for 2023 in the total amount of PLN 39,998,356.26, i.e. PLN 3.17 per share .The dividend date was May 15, 2024, and its payment is to take place on May 29, 2024. Since the debut on the WSE, the Company’s shareholders, considering the nearest payment, have received PLN 544.2 million.

– Since our debut on the Stock Exchange, we have been systematically sharing profits with our shareholders.

The total amount of dividends paid, with the latest tranche scheduled for May 29, exceeds PLN 0.5 billion. This is an expression of our desire to ensure that shareholders also benefit from the Company’s dynamic growth and derive real benefits from our common success. Despite the difficulties observed in the first quarter of this year. We look to the future with optimism. We are convinced that the expansion of the distribution model will be an added value in the long run, as will the further development of the product offer in other sales channels – summarizes Piotr Mikrut.