Śnieżka’s record-breaking year

In 2018, the Śnieżka Group generated record sales revenues. It also generated the highest profits in its history. The past year was also ground-breaking in terms of investments - the Group earmarked nearly PLN 70 million for the investments in question.

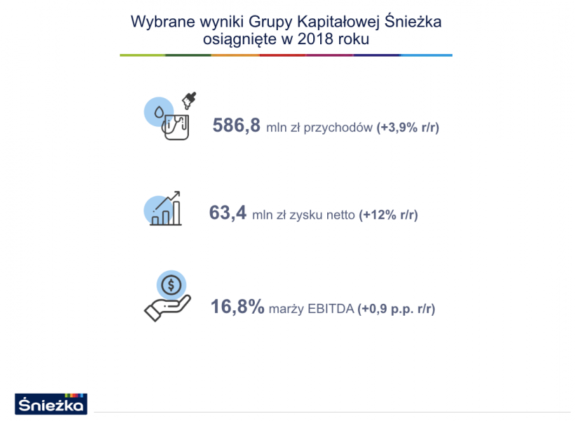

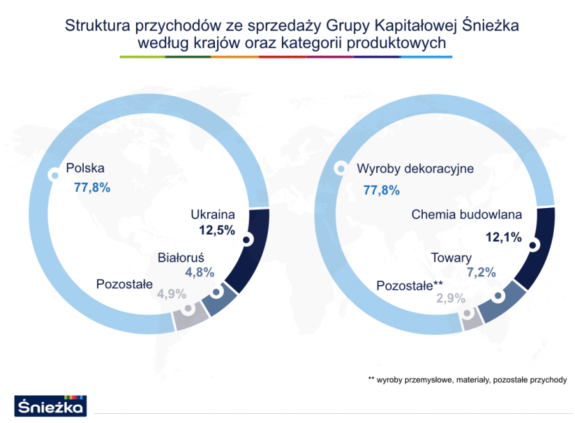

In 2018, the Śnieżka Group generated consolidated sales revenues in the amount of PLN 586.8 million, i.e. 3.9% higher than in the previous year. Such high performance is primarily a derivative of the revival on the market of paints and agents for the wood protection and decoration in Poland, which accounted for 77.8% of the total revenues of the Group.

For several quarters, we have observed that Polish consumers opt for better-quality, more expensive products. At the same time, the segment of cheaper products shrank. This was reflected both by our performance and in the data for the entire market of paints and varnishes in Poland - in 2018 the volume remained at a level similar to 2017, while the value of sales increased by several percent.

Last year, the Group also generated unprecedented profits: PLN 79.7 million (+ 7.8% y/y) on operating activities, PLN 98.4 million (+ 9.5% y/y) at the EBITDA level and PLN 63.4 million (+ 12% y/y) consolidated net profit. The net profit attributable to the shareholders of the parent company amounted to PLN 61.6 million.

Record-breaking investments…

2018 was an unmatched year for the Śnieżka Group, not only in terms of sales and financial performance, but also as to investments. The expenditure for this purpose amounted to PLN 69.7 million and was 122.6% higher than in the previous year.

Investments were related to organic growth through increased production capacity and process automation, which in turn has an impact on boosting efficiency. The modernization of colour paint production line was completed in FFiL Śnieżka SA, the parent company of the Group. High emphasis was also placed on streamlining logistics processes, increasing work efficiency and implementing new solutions in the management of this area.

We meticulously follow the first effects of activities undertaken in cooperation with SAP as regards the digital transformation - i.e. in the field of tools supporting the management of liaison with customers or supporting marketing activities. The next stages scheduled as part of the Change IT project will provide us with further competitive advantages in the field of modern methods of managing sales tools and relations with business and final customers.

A series of investments is also connected with the construction of our new Logistics Centre, which in 2021 will allow us to more efficiently and more effectively supply the market with our products.

… and strategic transactions

The Śnieżka Group has been consistently implementing the development strategy, which is based on long-term building of the leader position in the sector of decorative paints on the Central and Eastern European markets. In 2018, Śnieżka acquired the majority stake in Radomska Fabryka Farb i Lakierów SA – specializing in, inter alia, in the manufacture of anti-corrosive primers and topcoats.

In February 2019, the Company finalized negotiations with the owners of Poli-Farbe Vegyipari Kft. – a company with an established position in the sector of decorative paints for internal purposes in Hungary, which has one of the most recognizable paint brands on the market in its portfolio: Platinum and Inntaler (premium segment brands), and Cellkolor and Boróka (value for money segment brands). The acquisition of the majority stake in Poli-Farbe, for approx. PLN 108 million, will be the largest capital transaction in the history of Śnieżka.

Not only will the finalization of this transaction change the gradation of markets in the Group’s sales structure (as yet the second Ukrainian market will give way to the Hungarian one), but may ultimately be the key to the Group's expansion onto the markets of Southern Europe. Importantly, the acquisition of shares in Poli-Farbe reduces potential risks associated with the situation in Ukraine and Belarus, which will become our markets number three and four

Śnieżka prepared for the payment of dividends

Despite high investment expenditure, FFIL ŚNIEŻKA SA is well prepared financially to carry out investment tasks scheduled for 2019 and subsequent years. Moreover, traditionally, part of the profit generated in 2018 is to be allocated to the payment of dividends.

Śnieżka's revenues and profits are growing, and the debt ratios remain at a safe level. That is why we recommended the shareholders to pay a dividend from the net profit generated in 2018 in the amount of PLN 2.5 per share

In 2018, FFIL ŚNIEŻKA SA paid almost PLN 27.8 million (PLN 2.2 per share, and over 15 years of its operation at the WSE, a total of over PLN 336 million in dividends.